Your partner

in

agribusiness

Who we are

We believe that the foundation of all economies and societies is the food and agriculture industry. Hodler Asset Management is the only private equity firm in the Central European region with dedicated focus on this sector.

We manage two private equity funds focused on the agriculture and food industry investments in Central Europe. We consider every aspect of the food value chain.

Responsibility

Our investments and our portfolio companies serve a broad range of customers and make an impact on society as well as the environment. Consequently, we do not invest in businesses engaged in activities that are detrimental to local or global communities, the environment or the economy. We also never partner with investors with unethical business behavior. With that in mind we follow compliance and business ethics standards, promote reduction of environmental footprint and help to develop beneficial partnerships among all our portfolio companies.

Portfolio

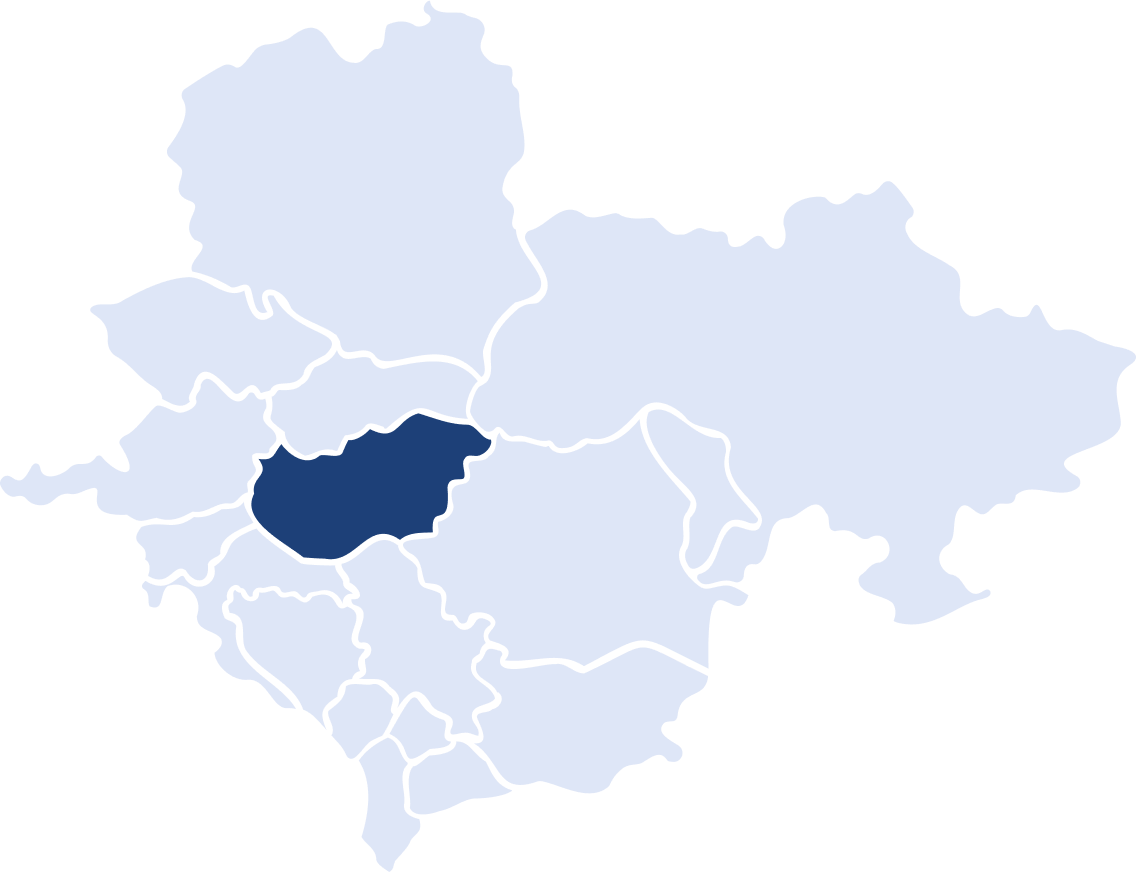

Gyulai Agrár

Gyulai Agrár Zrt. has 60 years of history and experience. Determinative agricultural company of it’s area, which provides a living for 90 employees.

Superior Foods

Superior Foods is one of the most important poultry slaughterhouses and processors in Serbia. The company, founded in 2014, operates in a fully integrated scheme.

Poultry Investment Group

Oprea Avicom

Oprea Avicom SRL is a dynamically developing company with 25 years of experience in the broiler industry: a family business built with a lot of work, dedication, perseverance and integrity.

AVICOD S.A.

The AVICOD S.A. is located in the middle of Romania, in Brasov county’s Codlea. It has three growing farms and owns a fully functional slaughterhouse.

Poultry Integration Farms

Through our company, Poultry Integration Farms srl., we purchased the assets of Sam Meat, Satu Mare, Romania. We are able to raise 7 million chickens per year at our 6 sites in the immediate vicinity of the Hungarian border.

Our Principal Values

Professionalism

We have gained our experience at reputable corporations, investment and advisory firms in the CE region and are investors on our own account in various fields, proving that we can achieve success at international scale.

Flexibility

We have established a flexible deal policy across deal types ranging from full equity through green field investments and leveraged buy-outs to recapitalization. Our equity contributions fall within the range of EUR 5 million to EUR 50 million, but we can draw in co-investors from our LPs or from a network of family offices we regularly work with to consume larger transactions. In general, our sweet spot is around EUR 5-15 million.

Long term owner mindset

We believe that value creation is more effective through control and our active involvement within the business. Although we generally prefer majority ownership, we invest in equal partnerships and also in minority positions with shareholders whose values and strategy are aligned with ours. We are not reliant on short term exit obligation, instead we are happy to formulate long lasting partnerships.

Innovation

We are convinced that in order to become a successful private equity investor in our focus sector, we need to address every aspect of our investments with curiosity and experimenting. This will lead to innovative solutions which is the foundation of value creation. In our investments, we seek to implement the most current technologies to allow the business to reach its full potential and we develop business models that are sustainable in the long run from an economic, social and environmental point of view.

Talent Management

We contribute to our investments through various means such as providing access not only to capital but also to our deep industry network and our talent pool. We are certain that the lack of well-trained employee is a fundamental bottleneck of successful businesses in this industry. Therefore, we consistently develop a talent pool of next generation managers of our focus sector.

The Team

Miklós Kerezsi

Chairman of the Board

Miklós Kerezsi is the chairman of the board of the Hodler Group and Hodler Asset Management, which were established to manage international agri-food investments.

Miklós Kerezsi

chairman of the board

Miklós Kerezsi is the chairman of the board of the Hodler Group and Hodler Asset Management, which were established to manage international agri-food investments.

Early life and education

After receiving an agricultural engineer qualification, he started his career at Szabolcs Gabona Holding Zrt. in 1996. From that point on, he had been rapidly climbing the corporate ladder and soon moved to controlling foreign investments.

Business activity

Since 2006, he has been developing and managing his own agri-food portfolio. Besides Hungary, he is mainly active in Romania and Serbia, but has interests in several other countries. The Hodler Group invests in grain trade (East Grain Group), fodder production (UBM Feed Romania), agricultural informatics (AgroVIR), industrial cleaning and detergent production (Chem-System), wine and spirit retail (Crush Distribution), fruit processing (H&S Fruits) and plastic industry (Star-Plus).

Talent management

He is the founder and co-founder of several university talent programs like the GTK Business Consulting Club, the Agro Consulting Club as well as the AgroVirtus agri-focused case study competition and talent management program.

Foundations

Member of the board of trustees and the supervisory board of the Jövő Nemzedék Földje Foundation, which is responsible for the asset management of the State Stud-Farm Estate of Mezőhegyes.

Member of the board of trustees of the Mosoly Foundation, which provides free-of-charge psychological therapy programs and positive experience programs for children who suffer from chronic disease.

Gyula Köbli

Chief Executive Officer

Gyula Köbli is the Chief Executive Officer of Hodler Asset Management and also member of the Board of Directors. He joined Hodler in June 2022.

Gyula Köbli

CEO

Gyula Köbli is the Chief Executive Officer of Hodler Asset Management and also member of the Board of Directors. He joined Hodler in June 2022.

After graduated at Budapest Economic University he started his professional carrier at Deloitte. He worked there for almost eight years as an auditor. Then he became a CFO at a medium size leasing company for a shorter period and after that he joined OTP Bank Plc. where he was the chief accountant.

In 2008 he joined FHB Mortgage Bank Plc. as a CFO, from 2010 he was co-CEO responsible for strategy and finance, and from 2013 he became the sole CEO. From 2017 to 2021 he worked as the CFO of Libri-Bookline, and then as the deputy CEO of Biggeorge Property and Biggeorge Asset Management. Gyula is a chartered accountant and member of the board of trustees at Dr. Nagy László Foundation.

Zoltán Verbó

INVESTMENT DIRECTOR, CIO

Zoltán Verbó

Investment Director, CIO

He graduated at Corvinus University majoring in management and organization. He started his career in transaction advisory at Deloitte Central Europe. He gained most of his transaction experience in the banking, telecom and food industries. He served as Head of M&A at Telenor Hungary from 2015. In 2017 he accepted a call from one of his former clients to serve as CFO of new venture that has become one of the fastest growing sport nutrition company in Hungary.

Since end of 2020, Zoltán is responsible for i) the development and execution of Hodler’s investment strategy and deal pipeline and ii) development of the investment team.

Zoltan is a father of 2. In his free time he likes playing golf, tennis and skiing.

Alpár kiss

Investment Director, CFO

Alpár Kiss

INVESTMENT DIRECTOR, CFO

Alpár Kiss is the chief financial officer of the Hodler Group. He has been assisting the corporate activity as a Partner since 2022. Furthermore, he takes on the investment director role for Hodler Asset Management.

He studied at Babeș–Bolyai University of Cluj-Napoca between 2012 and 2017. After completing BSc in Banking and Finance BSc, he earned a diploma in Business and Management Msc. He started his career as an analyst at Concorde Group, then returned to his alma mater as a lecturer teaching corporate finance, mathematics, insurance, and investment decisions. He has been involved in the work of the Hodler Group since 2017.

At the beginning of his university studies, he joined the GTK Business Consulting Club, which he still actively supports today as a coordinator and lecturer. The experience he gained within the program had a remarkable impact on his career path. He believes in the significance of talent management and stands by the power of professional humbleness.

Péter Magyar

Legal Director

Péter Magyar

Legal Director

Péter Magyar is the legal director and senior investment officer of Hodler since April 2022. After graduated at Pázmány Péter Chatolic University Faculty of Law he started his professional carrier at the Metropolitan Court of Budapest as a trainee judge in 2004.

After the bar examination he had been advising multi-national companies on corporate, commercial and competition law issues. In 2010 he joined the Permanent Representation of Hungary to the EU in Brussels as a carrier diplomat of the Ministry of Foreign Affairs dealing with transport-, energy, corporate- and competition law dossiers. Since 2015 Péter as a senior diplomat of the Prime Minister’s Office had been responsible for the relations between the Hungarian Government and the European Parliament in i.a. legal, budgetary, commercial and financial matters.

In 2018 was appointed as a director of the Hungarian Development Bank. Between June 2019 and February 2022 Péter was the Chief Executive Officer and the member of the Management Board of the Diákhitel Központ Zrt. (Student Loan Facility Centre PLC). Since 2019 he has been the member of various investment committees of the Hiventures Ltd. (leading ventures capital fund management in the CEE region). Péter was appointed as a member of the Supervisory and Audit Board of the MKB Bank and of the Management Board of the Magyar Közút Zrt. (Hungarian Public Road PLC).

Antónia Csiszár

Operations and Compliance Manager

Antónia Csiszár

Operations and Compliance Manager

As Head of Operations and Compliance, Antónia Csiszár and her 2 colleagues support Hodler Fund Management team from June 2022.

She completed her studies at College of Foreign Trade, University of Pécs and at ELTE Institute for Postgraduate Legal Studies, thus obtaining an MSc in economics with a legal degree, which was supplemented in 2021 with a Master of Real Estate Management degree at Corvinus University in Budapest. For nearly 20 years, she held various positions in Budapest Bank group owned by GE. She was responsible for sales support at the Budapest Fund Management Company, which operates as a subsidiary of the bank, and then held the position of Operations Manager in addition to the position of Compliance Manager for two periods.

Meanwhile, between 2007 and 2009, she worked as an internal auditor for the subsidiaries of the Bank, Budapest Auto Financing, Budapest Leasing and Budapest Fund Management Co .

She held similar positions at some smaller fund management companies, and then joined Diófa Fund Management team as a one-man internal auditor in 2018.

Mother of 3.

Balázs Posch

Investment Director

Balázs Posch

INVESTMENT DIRECTOR

Balázs joined Hodler’s team in August 2022 as investment director. Earlier he worked as managing director of commercial and recreational facilities for 6 years, leading their reorganization and preparation for exit.

At this time, he also developed business plan and commercial strategy for several landmark projects with his team. Prior to that, he worked for 12 years at the asset management holding of Mr. Sándor Demján, a renowned entrepreneur of the era, where he could gain experience in several industries and positions. He fondly recalls the development of a 120MW power plant and the subsequent exit, as well as being asset manager of leading shopping malls in the CEE region.

Balázs gained his MSc at Corvinus University, Budapest (2004) and his MBA at ESCP Business School, Paris (2019).

As it is important for Balázs to see the wider social benefit of his job, he finds it rewarding to work on the agricultural development strategy of Hodler.

Balázs is a father of 3, he likes hiking and sports, and he hasn’t given up on learning proper German one day.

Hunor Szép

Investment Analyst

Hunor Szép

investment analyst

Hunor currently works as a financial analyst at Hodler Asset Management. Prepares evaluations, support- and controlling materials.

He graduated from the Babeș-Bolyai University with a BSc degree in Finance. During his years at university constantly worked to cover the costs of his studies. He advised several Romanian SMEs with his firm.

He is an alumni member of the GTK business consulting club where he gained access to a great source of knowledge, network, and friends.

Máté Bodnár

Investment Analyst

Máté Bodnár

INVESTMENT ANALYST

Máté is an investment analyst at Hodler Asset Management. He prepares valuation models, support- and controlling materials.

He graduated from Corvinus University of Budapest with a BSc degree in Applied Economics and a MSc degree in Finance with corporate finance specialization.

Previously, he worked at Morgan Stanley, Raiffeisen Bank, and Invescom Corporate Finance as an intern.

Ákos György

Investment Analyst

Ákos György

investment analyst

Ákos György has been a junior analyst of the Hodler Capital group and a junior investment analyst of Hodler Alapkezelő Zrt. since spring 2021.

He studied finance and banking at the Babeș-Bolyai University in Cluj-Napoca as a bachelor’s degree, and currently holds a master’s degree in Management and Organization at the Corvinus University in Budapest.

During his undergraduate studies, he became a junior and then a senior member of the Economic Consulting Club, where he currently helps the members’ development as a returning alumni. During his university years, successful participation in many international competitions helped his professional development.

Dénes Barta

Executive Assistant

Dénes Barta

Executive Assistant

Dénes directly supports the work of the chairman of the board as a personal secretary.

He graduated from the Corvinus University of Budapest in 2022. During his university years, he joined the Agribusiness Club (formerly Corvinus Agribusiness) student organization, of which he eventually became the president. He interned as a junior salesperson at Agrármarketing Centrum Kft., and as a junior market researcher at Market Insight Kft.

Currently, he is also responsible for the Agrovirtus agri-focused university talent program.

Júlia Hegyiné Szakonyi

Back Office Executive

Júlia Hegyiné Szakonyi

BACK OFFICE EXECUTIVE

Júlia Hegyiné Szakonyi has been strengthening the team of Hodler Asset Management Ltd. since June 2022 as a Back-Office Executive.

She earned her first degree as a teacher of English language, later she graduated from Corvinus University with a degree in Public Administration. She worked as the Office Manager of the Hungarian Water Cluster for nine years.

From 2018 she worked as an Operations Assistant at Susterra Capital Partners. Currently she attends the Green Brands Academy Certified Sustainability Manager Training. Mother of three children.

Gabriella Ruttkay

Office manager

Announcements

Contact us

OFFICE

1123 Budapest, Alkotás Street 53., Building D, 5th floor

PHONE NUMBER

+36 1 617 5683